A routing number is a unique number that identifies a specific banking institution. Each routing number is made up of nine digits. Routing numbers are sometimes referred to as an American Bankers Association routing transit number or an ABA RTN. Large multinational banks can have several different routing numbers, typically based on the state in which someone holds an account. To find your routing number, here are four ways to look for it: Meanwhile, small banks usually have just one routing number. Remember that you won’t get a routing number on a debit card, as your debit card uses an entirely different numbering system The routing number is almost always located on the bottom left side of the check, but sometimes it’s listed in the middle. By logging into your online bank account.We’ve linked the routing numbers of 10 of the largest commercial banks in the United States: When you’re logged in to your online account, you should be able to find your routing number under your checking account information. If you’re unable to find your bank’s routing number or want to double-check that you have the right one, contact your bank.

When Do You Need to Know Your Routing Number?Īccount and routing numbers work together to identify your account and ensure that your money ends up in the right place. An account number is your bank customer ID, and it is unique to every account holder. Routing numbers aren’t unique to each person: they correlate with banking institutions to indicate exactly where funds are coming from and going to during a transaction. It is important to note that some banks have different routing numbers for deposits.

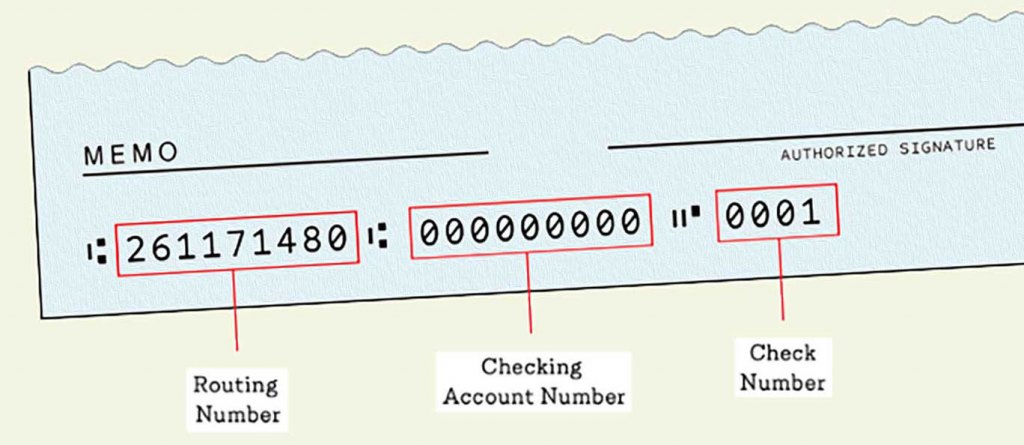

To locate the routing number on your check, look for the first set of nine numbers on the MICR, which are typically positioned between two special symbols (See Image Below). What To Do If Your Routing Number Changes Here are some common scenarios when you’ll need to know at least your routing number: Both are required to complete most basic banking transactions. There are nearly 27,000 routing numbers currently in use.

#Checkbook routing number full#

You can then choose, See full account number next to your account name and a box will open to display your account and routing number. If two banks merge or if one bank acquires another, your routing number might change. Find your routing and account number by signing in to and choosing the last four digits of the account number that appears above your account information. It’s a rare occurrence, but if it happens, it’s helpful to know what to do. As an account holder, you’ll be given notice of the change with enough time to make adjustments.

0 kommentar(er)

0 kommentar(er)